Glyphosate is the most-used herbicide across the world.

Glyphosate, a glycine derivative broad-spectrum and non-selective herbicide holds the largest market share among herbicides, globally. Furthermore, it kills weeds more effectively without affecting crops compared to other commercially available herbicides.

Renowned chemical manufacturers such as DuPont and BASF are manufacturing glyphosate under brand names Abundit Extra, KIXOR, respectively. However, usage of 2,4-D, is banned in countries such as Canada, Denmark and Norway due to the high level of dioxin contamination and risk of spreading cancer.

According to the 2014 report, World Herbicides Market - Opportunities and Forecasts, 2013 - 2020, the usage of organic herbicide as a replacement of 2,4-D, is being considered worldwide, although the effectiveness of organic herbicides to control weed is still under research.

Currently, bio herbicide is a niche segment of the global herbicides market. These are composed of microorganisms such as fungi, bacteria and insects that can target specific weeds without harming crops. Currently, commercial production of such herbicide is very low. However, due to their lack of chemical toxicity and milder effect on environment, the popularity of bio herbicide as compared to synthetic herbicide is growing. Considering the potential of bio herbicides, companies such as Bioherbicides Australia, are focusing on research and development and commercialising bio herbicides. Myco-Techpaste and Sarritorare are two Canadian brands of bio herbicides, which are currently commercially available.

Among different crop types, herbicide usage is highest in cereals and grains (namely maize, rice, wheat and others). The Asia-Pacific region (Mainly China, India and Japan), being the major production hub of cereals & grains, consumes nearly three quarters of total herbicide in this category.

Featured articles and news

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

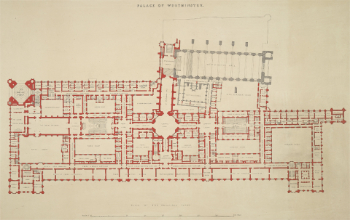

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this...

National Apprenticeship Week 2026, 9-15 Feb

Shining a light on the positive impacts for businesses, their apprentices and the wider economy alike.

Applications and benefits of acoustic flooring

From commercial to retail.

From solid to sprung and ribbed to raised.

Strengthening industry collaboration in Hong Kong

Hong Kong Institute of Construction and The Chartered Institute of Building sign Memorandum of Understanding.

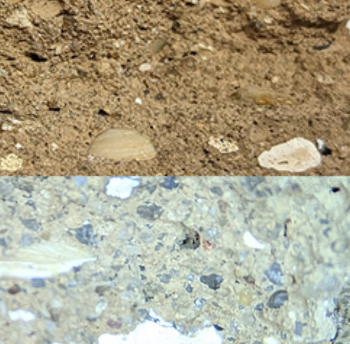

A detailed description from the experts at Cornish Lime.